I almost caught the dragon

VCs are in the business of chasing dragons. The earlier you meet the VC ahead of your stage, the more information you are providing. If they don't invest and you meet them in a year or so, they can quickly check their old notes. You might end up not being a potential dragon.

But what does chasing dragons mean? Here comes the fundamental read on how VCs manage their portfolio and how can you become a potential dragon candidate?

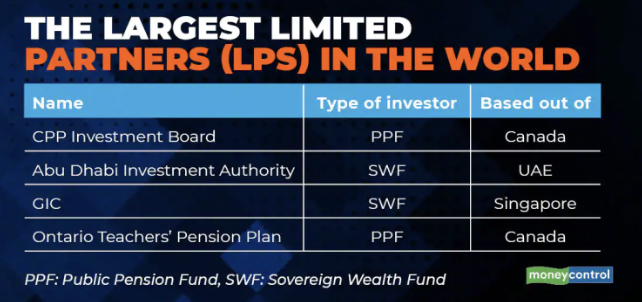

The largest LPs in the World.

Let's say a VC reaches out to CPP in Canada (by the way you can find their reports online). Amongst the assets classes that CPP invests in, VCs represent one of the most illiquid and riskiest assets classes. As Fed interest rates set the bar for overall returns, LPs expect much higher returns than what can S&P500 can bring (12.39%, L10Y avg. as of this writing). Let's say 25%+ IRR. This roughly equals to 3X return by the end of the fund's life.

You might say "Ah then my startup only needs to return 3x" NOT SOO FAST!

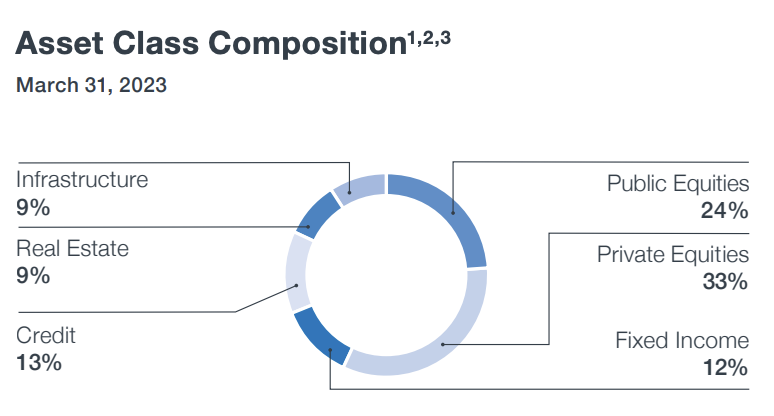

CPP'S Asset Class Composition. VCs fall under Private Equities.

Remember 90% of startups fail? With that assumption as VC, my job is to go big or go home. Find the 10% that will over deliver and save the fund. Suddenly 3x becomes 30x+ expectations from your startup. I need to find markets (not startups) that will go through massive transformations and deliver massive growth year on year.

My secondary job is quickly finding the startups in my portfolio that are default dead (the 90%). So that I don't put super valuable extra capital that I could have double downed on my dragon.

You see? My motivation is not to worry about downside as much. Since my destiny is tied to that 1-2 home runs per fund.

So, a startups failure does not hurt the VC as much as not investing enough on the winning portfolio company. Another mistake is also investing more time on the losing ventures that I could have helped nurture my top startup. This is why you might suddenly drop from the radar of the partner and become the black sheep of the family.

VCs usually not give all your investments in one. They earmark ~2/3 for follow ons.

Let's say a VC has $100M to invest. The fund needs to return $300M. She chooses 10 portfolio companies in first 3 years of the fund, with $10M potential to invest in each.

As I entered with the lowest valuation, I should put all $10M in go for bigger ownership, right?

Not true! I rather trade my time with giving up some ownership. Why? Because I want to de-risk my investment and see if you are a dragon or a dog. Hence, I give you $3M first and keep $7M for after the time I have more intel on your venture.

This is what I mean by "Countdown begins the moment you accept the VC money". Post receiving VC money, you have 12-24 months to show that you deserve the follow-on investment.

The smartest or the luckiest VC on Earth.

This is what I mean by VCs optimizing for the dragons. If the VC plays her cards right, they put most of their follow-ons (capital & time) on the winners. The above fund will probably one of the best of all times and will instantly attract top LPs for the 2nd fund.

But how can you become a dragon?

End of Part

Coming Next

How to become a (potential) Dragon.

How to create FOMO for your market (not yourself/your team).

How to demonstrate that you are the right domain authority to tackle this market/opportunity.

Bonus Stuff

Join us at Fundraising Success Group on LinkedIn where we share more in-depth insights and real startup examples.