How to create FOMO & grab the attention of top investors

Let’s turn some heads around.

There is strong self-fulfilling prophecy / feedback loop in VC business. Is Sequoia Capital or YC the best when it comes to deal sourcing, portfolio management? Or is it a result of top startups applying for their cache and only thing left for them is cherry picking the cream of the crop? Former seems more likely.

Their and many of other top VC's reputation is built on their first couple of home runs. That's why you keep on hearing about Airbnb when it comes to YC and about Apple when it comes to Sequoia Capital. These are the first dragons that built the YC/Sequoia house.

But how can you become to dragon for the current funds of these Tier 1 VCs? One (or 4 words): FOMO

VCs are always in hunt for the new disruptive industries. Searching for the next Apple (PC revolution), Netscape (internet), Google (data-search), Facebook (search) & Wework (😆 just joking). Looking for a new entrant who will create a new market out of thin air and change user habits forever. Then the future cash flows coming from #1 spot will cover all the initial unprofitability.

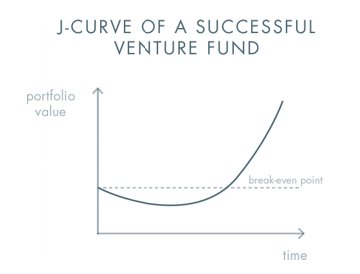

The Power Law Runs the VC World.

An average VC needs to sift through 100s of decks and presentations per year. Regardless of their mandate (e.g., we are AI focused), they cannot become an expert in any field as they need to study many different business models. Unlike a domain expert founder, who is spending countless 10.000 hours to dominate her respective market. And this as a founder, is your unfair advantage and your way in.

As we covered in our last article, VCs are not worried about startups going bust (the downside) but missing out on that 1 dragon that brings 30x+ returns and saves the fund (the upside). And technically, they don't have FOMO on missing out on a startup/founder but instead missing out on a key new market (AI-crypto-AI-again etc.)!

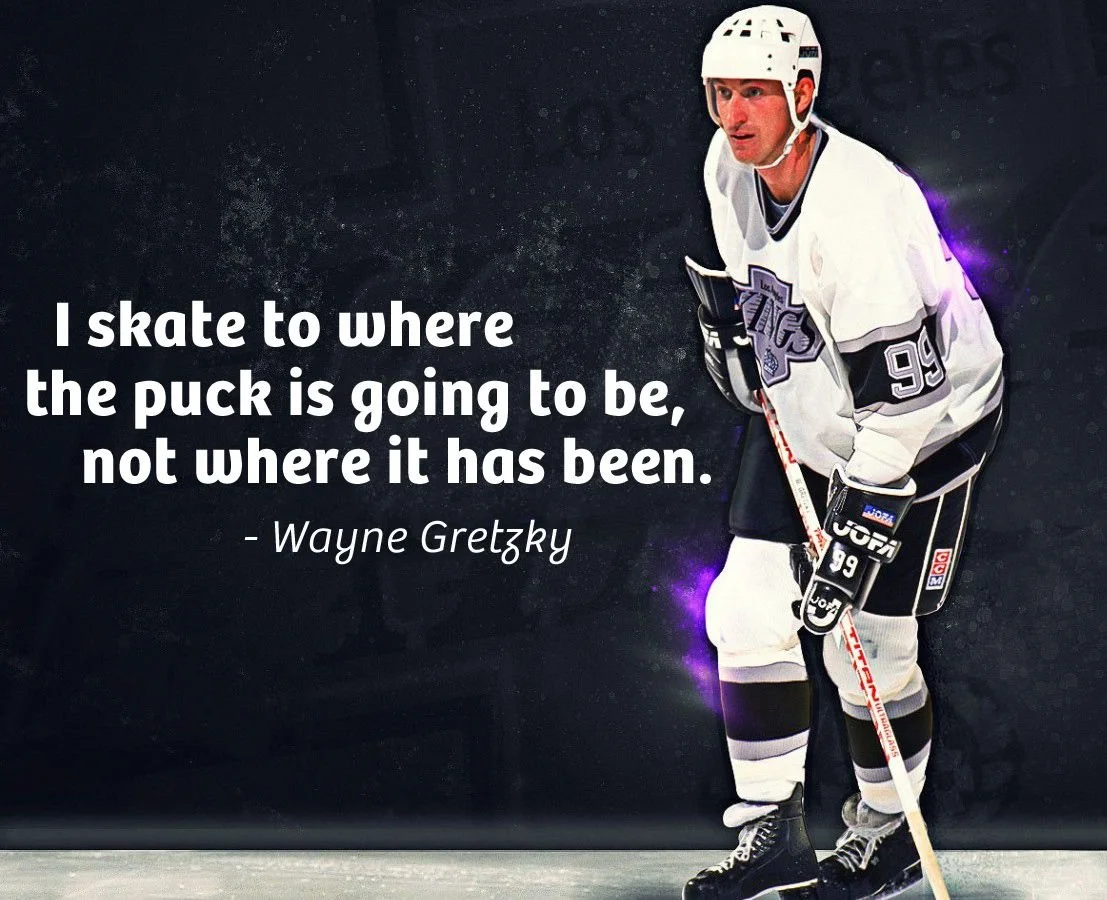

When knocking on the doors of the VCs your primary job is to show that you are the ultimate domain authority on your new and sexy market. The goal of the first meeting is getting the 2nd meeting, ideally with the managing partners. If you show that you know where your market is heading in next 5-10 years, then this is the meeting they look forward to.

Show them where your market is heading and why you are the only one to spot this trend.

Remember, they have limited time, going through tons of crappy decks and cold emails (please don't send them) and this kind of meeting is that lights up their day. So, your job is to show your conviction, why you are betting your house on this idea/market and pouring your life savings into your startup.

Most people mistake charisma with conviction. You don't need to hype yourself to be a charismatic leader.

If you have a strong conviction (you can be introvert etc.) that's shines through. It attracts top talent and capital. It's impossible to fake. Charisma can get you to maybe couple of deals but soon you will run out of steam as you need a decade long endurance to succeed. Conviction lasts much longer as long as you have answer to the questions "Why?"

This is why the only way to show that you are the domain authority is to show over and over why you have conviction for your idea.

Knowing your why = conviction = becoming a domain authority.

Second ingredient is bias for action. How is your progress between the meetings? You should share more things and validations that you find on your market. This proves that with or without their money you are moving forward. If they join now, it will be best deal, if they join late, they will pay premium.

I meet some founders, who have a super amped up first meeting then go radio silent. After a month or two I send them a follow up message. I see they are still adjusting their pitch decks, asking for intros etc. When I ask, "What have you done since the last meeting?" They answer with the list of people they met. The expected ideal responses are:

Remember our initial assumption X? That did not turn out to be true.

We learned 1-2-3 from that experience.

Now we have a better way to reach to our target market. We are working on Y.

See what happened here? I get to learn more about that sexy market even though you failed in your experiment. And I know that you are hellbent on iterating rapidly to crack this market right open. Now that's passionate domain authority in the making.

Now how can you make sure your market is sexy? What does an attractive market mean for a VC?

End of Part

Coming Next

Why an average team in a good market beats great team in a crappy market?

How to correctly name your TAM?

Why top-down calculations ruin your chances with VCs and how to plan bottom-up?

Bonus Stuff

Join us at Fundraising Success Group on LinkedIn where we share more in-depth insights and real startup examples.