How to find Go2Market Chokeholds & Build your moat

In the last part we covered why growth vs profitability is a false dichotomy. As a startup your key focus is rapid growth to hit escape velocity before incumbents catch on to your new business model. So, how can you grow this fast, while showing profitability? This is where understanding your Go2Market chokehold comes into play.

Go2Market Chokeholds

A simplified business model and go2market table

Before jumping into any complex financial models, it's best to start with above table. Upper part shows how your Go2Market works, from supply to demand. Below part shows your business model, how you generate revenue, what are your cost structures. I always ask fellow founders to map this table in couple minutes. This immensely helps to structure their thinking and quickly spot feasibility of their business model.

Looking at Go2Market, supply-to-demand journey of your industry, always think about the most painful point, the chokehold of serving your target market. Why finding the chokehold is crucial? This is the key pain point that customer have the highest willingness to pay. This is where the fat margins lie.

You can ask your customers all of their pain points and they will gladly share 100s of issues. DON'T DO THAT

Instead map the full value chain and find a single pain point that can help you monetize from day 1. In the example of Tesla, they started with Roadster aimed for rich people who wanted to have a cool electric toy. The margins from Roadster trickled down to the production of Model S which is also aimed for high income tech crowd. Finally Model S's margins with scale help invest in capex required to build a mass market model X & Y.

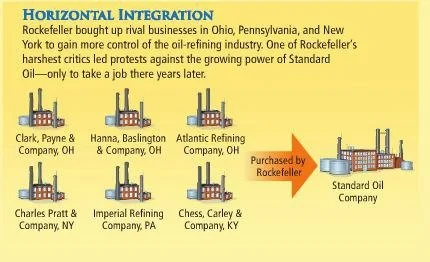

Rockefeller did not get rich from drilling oil. He found the chokehold in the value chain serving the market.

Similar example applies to John D Rockerfeller. When everyone was going after gushing oil fields, as a disciplined accountant he studied the full value chain and decided oil refineries will become the key chokehold. He worked consolidating and monopolizing the refineries. Then, when the market evolved the new chokehold became the distribution. He disrupted the railway tycoons (e.g., Cornelius Vanderbilt) by building oil pipelines. He always solved for the chokehold & margins first.

Finding the high-margin pain-point serving the unbanked market

Now, let me share an example from our company. We first decided that local trusted agents were the right channel to serve our massive 225M unbanked Indonesian market.

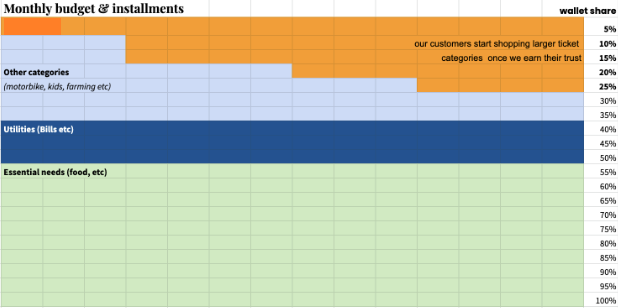

First, we started mapping every single item an unbanked household purchase frequently. From the initial looks, food & utilities seems like to ideal categories, which make 60-70% of the total money spend.

Second, we dived deeper, we checked who else serves these categories, what are the margins etc. We quickly found out the richest local families and established CPG brands were dominating these categories. As these categories were mature, the margins were already settled at low single digits % and incumbents were fighting for minor %pt wins. Even we might achieve revenue growth, we will be bleeding in a low profit red ocean.

$ wallet share of an example unbanked household.

Third, we tackled the issue using first principle thinking. We changed our question to "What is the profit distribution per category for an unbanked household?" Then, suddenly we faced a completely different outcome. High ticket items such as white goods, furniture, electronics, smartphones, motorbikes etc., represented only 40% of the wallet share in but in reality, they claimed 90% of the profit share.

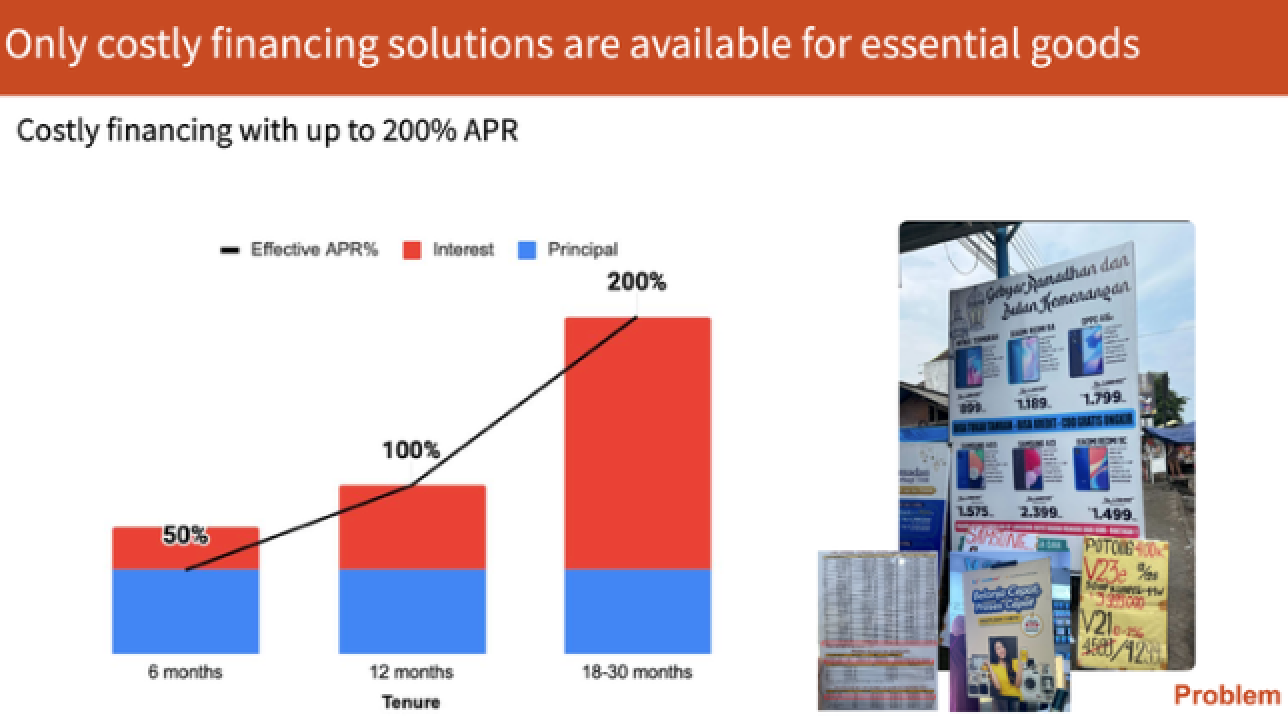

These high-ticket items had unique go2market characteristics especially for the unbanked communities. These communities always opt-in for payment with installments for high price products BUT as they were unbanked, they had no access to credit. They usually knocked at the doors of loan sharks and were charged extremely high interest rates. E.g., a Honda motorbike which costs $1000 in Jakarta ended up costing $3.000-$4.000 with 36 months payment plan and $300 Oppo smartphone ended up costing $750+ with 12-24 months payment plan.

Unbanked households end up paying high fees due not having credit rating.

This is how we end up finding our high-margin go2market chokehold that can help us both hyperscale to $100M revenue levels, while also building our MOAT and avoiding low-margin red ocean categories.

So far, we covered

Choosing the right distribution channels

Building $100M revenue bottom up with business drivers

Focusing on 5-7 years hypergrowth plan

Finding the chokehold, high-margin streams of revenue

Now we can move on to cost part of the business model.

End of Part

Coming Next

What is unit economics?

Why you need to start thinking in cohorts instead of a monolithic customer base?

How to build LTV/CAC for different cohorts?

Bonus Stuff

Join us at Fundraising Success Group on LinkedIn where we share more in-depth insights and real startup examples.