Your startup is profitable. You just didn't notice how.

If you made this far, that means you are already on top of choosing the right distribution channels, building $100M revenue bottom up with business drivers, focusing on 5-7 years hypergrowth plan and finding the chokehold, high-margin streams of revenue.

Assuming that we have secured high margin revenue streams (high LTV), now it's time to tackle the cost. Finding the lowest cost way to serve this market, calculating our CAC and measuring our unit economics via LTV/CAC & price waterfall.

We are on the last part, bottom-left: the costs.

Calculating CAC | Do things that don't scale

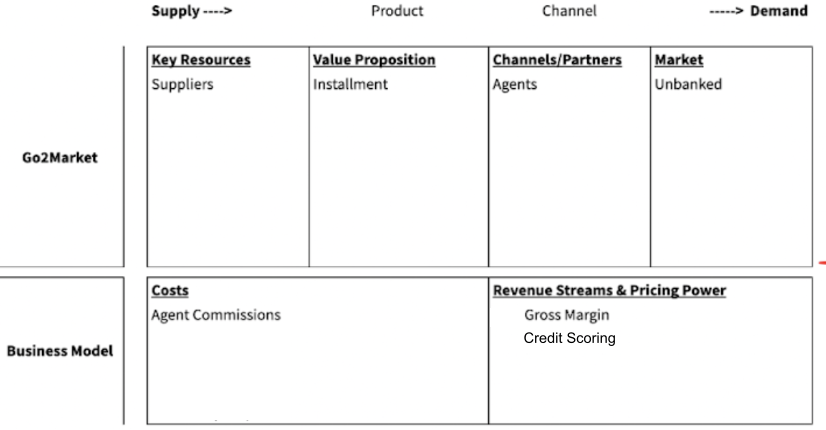

I will keep bringing up this table as it helps us stay structured and avoid delving into any complex financial models. In our business model, we had strong take rates (60%+ vs traditional 5%-10% for marketplaces) this gave us enough room to experiment with different ways to acquire agents and for our agents to acquire their neighbors.

For the first 10 agents and 100 customers we did nothing digital. Our goal was to fully map their experience and build a white glove service for them to sell to their neighbors.

Most of the founders immediately go to Facebook and use its analytics tool find the target audience. DON'T DO THAT

Always build your first 2-3 sales yourself. This is what Airbnb team did after listening to YC's Paul Graham's advice. Do Things that Don't Scale (paulgraham.com) This is your golden chance to find the cheapest ways to serve your target consumers.

Each time we visited our local agents we found out their key issue was product sourcing and access to working capital. The products that ended up in a local shop in their village was not what they needed. They were sending their relatives to shop in Jakarta. The number of products they can receive was limited to what can be carried in a suitcase. Plus, only once in 3 months or so their relatives were visiting big cities.

We asked them, "What if we were to source you any products you wish? Can you sell them to your community?" The answer was a resounding yes. So, each and every single product in our catalog was decided by a team of key opinion leaders from each village. This resulted in no guess work, sourcing handful of categories at scale and close to 0 returns.

Testing a new product category on the ground.

Then we asked, what is the best way you can communicate your products to your neighbors.

Surprisingly, they asked for no tech. They were able to forward the product links to their neighbors via WhatsApp directly from our app. What they needed was an offline, physical presence to demonstrate trust. They requested physical printed catalog (like Ikea), banners to cover their homes & shops and branded t-shirts to show that they are part of our squad.

Our Agents gathering, they were designing our product catalog.

At that time CAC using Facebook ads costed around $20+ (it should be even more expensive now). Our catalog per household only costed $0,50 and costs for banners etc. were negligible. On top, we gave 5% commission to all our agents.

P.S. this resulted in more than $1M yearly income distribution and a massive positive social impact.

They were extremely active in their community and on their own Facebook pages. The pages of our agents had more followers than our company account. We ended spending $0 on Facebook advertisement.

Our agents promoting an offline event on their Facebook page.

For calculating your CAC, ALWAYS do the first couple of sales yourself and find out the most cost-effective way to serve your customers. This is not something you can do from your home/office jumping on to conclusions on your laptop using Facebook targeting.

Calculating LTV

Now we have the CAC. Next step is to calculate the lifetime value. In our case, LTV was actually a moving number. As more trust was built between us and the agents and agents and customers, the more household categories they shopped from us. (like switching to MacBook after enjoy using iPhone). Our year on year per location (per agent) sales has increased on average 7X.

This applies for your business model.

Do you foresee an increase in wallet share?

Do they refer your product to other users?

Take this into account when building a lifetime value estimation for your business model.

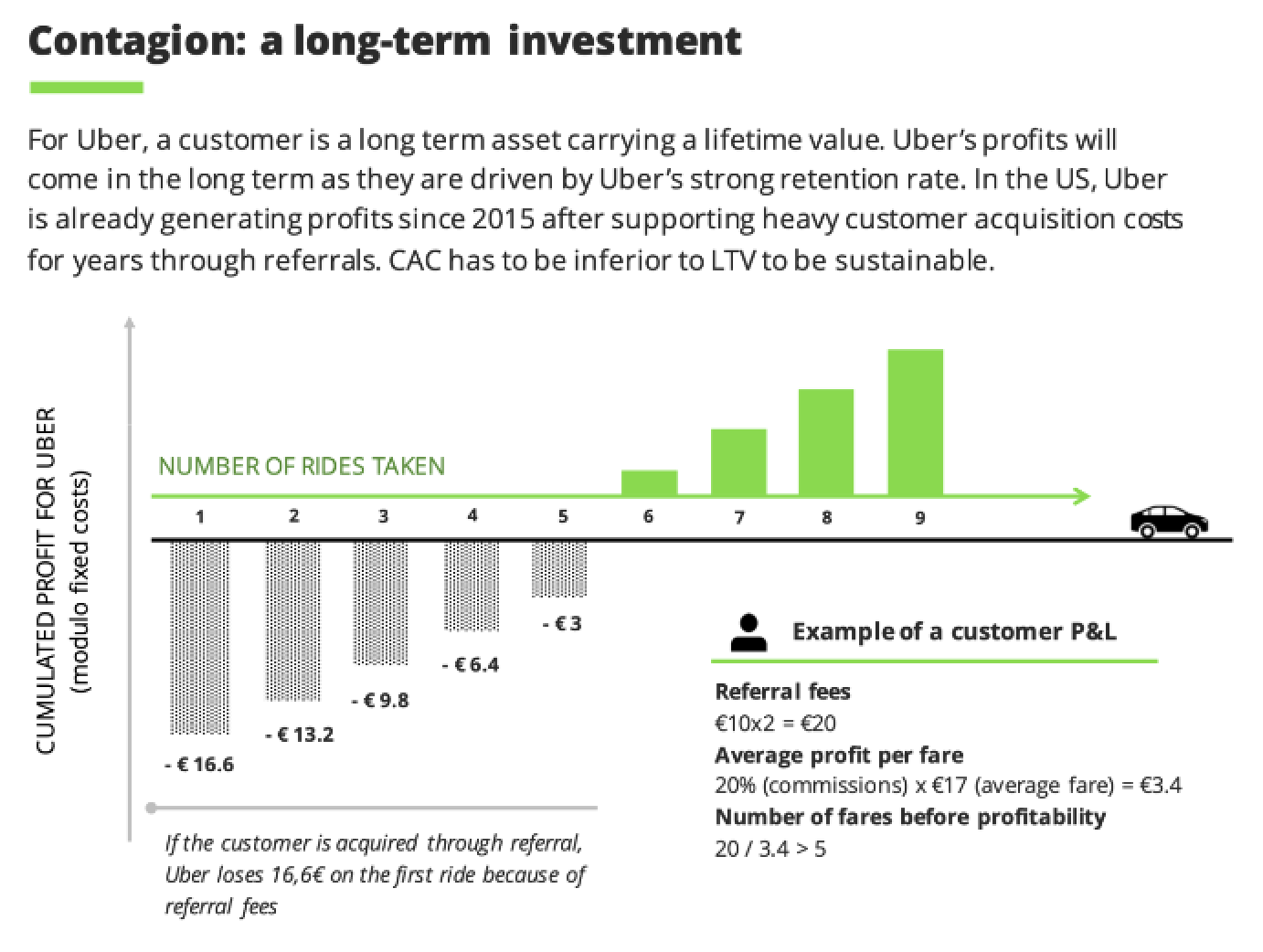

A lifetime P&L | Uber Example

Your model might look unprofitable at first. Take into account future revenue streams.

Retention % (1-churn rate) is the quickest way to show the lifetime of your customer. Let's say you have 20% yearly churn then your customer's lifetime is 5 years. Then, multiple that number with average revenue per user and find consumer lifetime value (LTV or CLV).

See the uber example. You might say, "They are giving money away to get users". Is it tough? They estimate how many rides they need per user to breakeven. This should be the number to find for your company and north star metric to rally your troops behind.

Plus, always use your old cohorts to your advantage. Show that your old cohorts already have profitable unit economics. You are now raising money for hyper growth and acquire seemingly unprofitable new users whom in future will be your new profitable cohorts.

And this is why Profitability vs Growth is a false dichotomy.

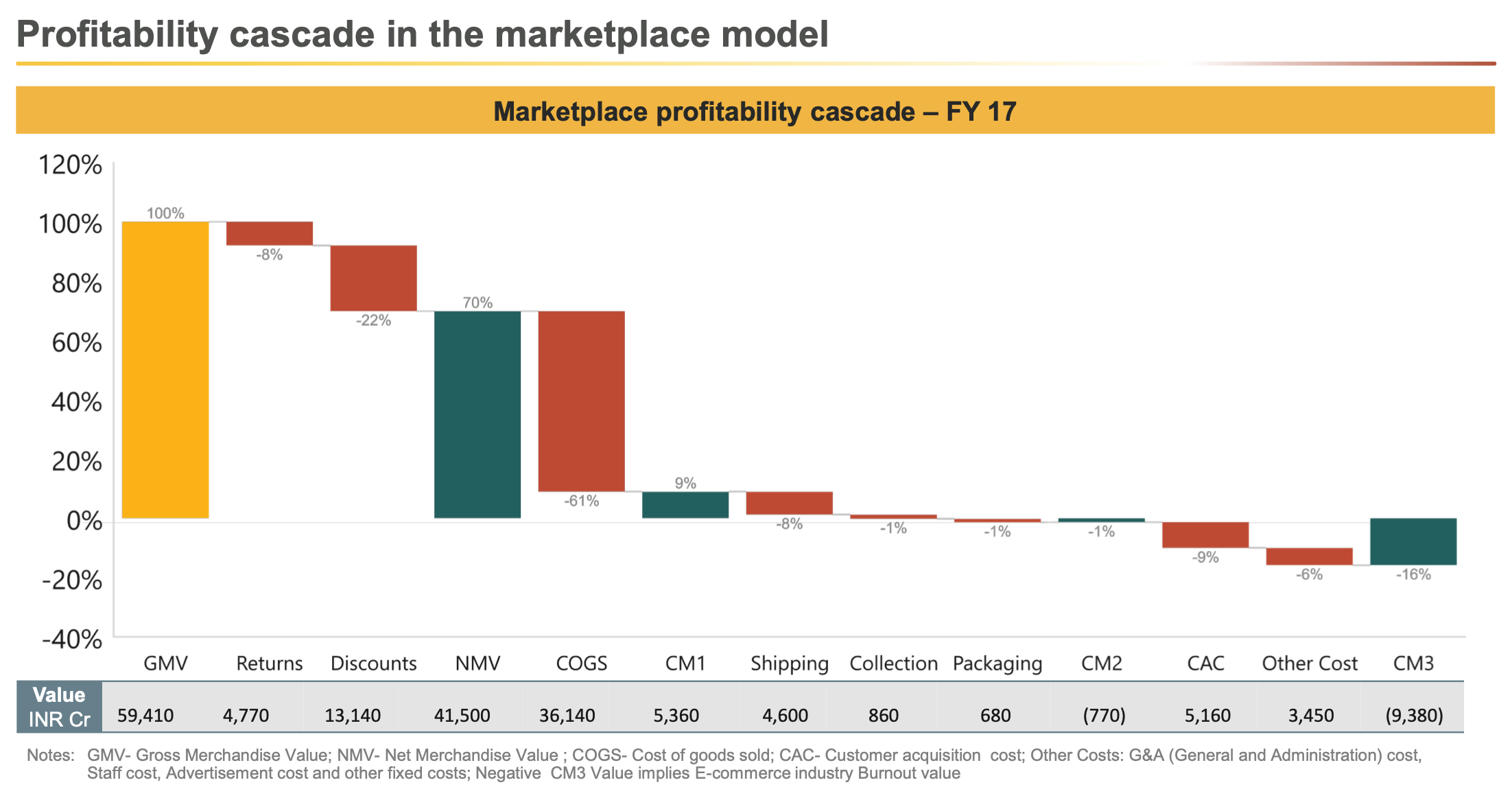

Building price waterfall

Another good technique to show your P&L is using price waterfalls (profitability cascade). Above is a good example from mature Indian marketplace players. How come they can still raise while looking unprofitable? Because they show the stickiness of their old cohorts, and they are still in the stage of acquiring new customers. This is why Prime is the bread and butter of Amazon and has one of the highest penetration and yearly renewal rates (PS they copied the Costco playbook). As they know, after X number of purchases, an average amazon customer becomes profitable and stays for life.

In our case, our average village become profitable in 3-6 months' time. This is how we were able to raise more funds to open more locations, albeit the new locations looked unprofitable at first and company level we were in the red.

Bonus Stuff

Join us at Fundraising Success Group on LinkedIn where we share more in-depth insights and real startup examples.